| NO | TITLE | DATE |

|---|---|---|

| 1 | "ST Lupuskan 2,933 Barangan Rampasan Bernilai Lebih RM1.7 Juta" | 04/06/2025 |

| 2 | The Energy Commission of Malaysia (ST) and Korea Gas Safety Corporation Strengthen Ties Through MoU on Gas Safety Cooperation | 25/04/2025 |

| 3 | The Current Electricity and Gas Supply Situation in Peninsular Malaysia Following the Gas Pipeline Explosion in Putra Heights, Subang Jaya | 07/04/2025 |

| 4 | "ST Seru Orang Ramai Utamakan Keselamatan Elektrik dan Gas di Musim Perayaan" | 26/03/2025 |

| 5 | "Makluman Terkini Mengenai Penyesuaian Program Solar untuk Kegunaan Sendiri (Solar for Self-Consumption - SELCO) Termasuk Pelaksanaan Caj Tunggu Sedia (Standby Charge)" | 25/03/2025 |

| 6 | "Notis Pemakluman Berkaitan Permohonan Juruaudit Tenaga Berdaftar di Bawah Akta Kecekapan dan Konservasi Tenaga 2024" | 21/03/2025 |

| 7 | "Notis Pemakluman Berkaitan Nilai CDP bagi Pembaharuan Perakuan Amalan Pengurus Tenaga Berdaftar di bawah Akta Kecekapan & Konservasi Tenaga 2024" | 17/03/2025 |

| 8 | "Pelantikan Ketua Pegawai Eksekutif Suruhanjaya Tenaga (ST) Baharu" | 19/02/2025 |

| 9 | "Pemain Industri dan Komuniti Perniagaan Beri Respon Positif Berhubung Cadangan Semakan Semula Jadual Tarif Elektrik" | 05/02/2025 |

| 10 | "ST Akan Adakan Sesi Libat Urus Berkaitan Jadual Tarif Elektrik bersama Pemain Industri dan Komuniti Perniagaan" | 04/02/2025 |

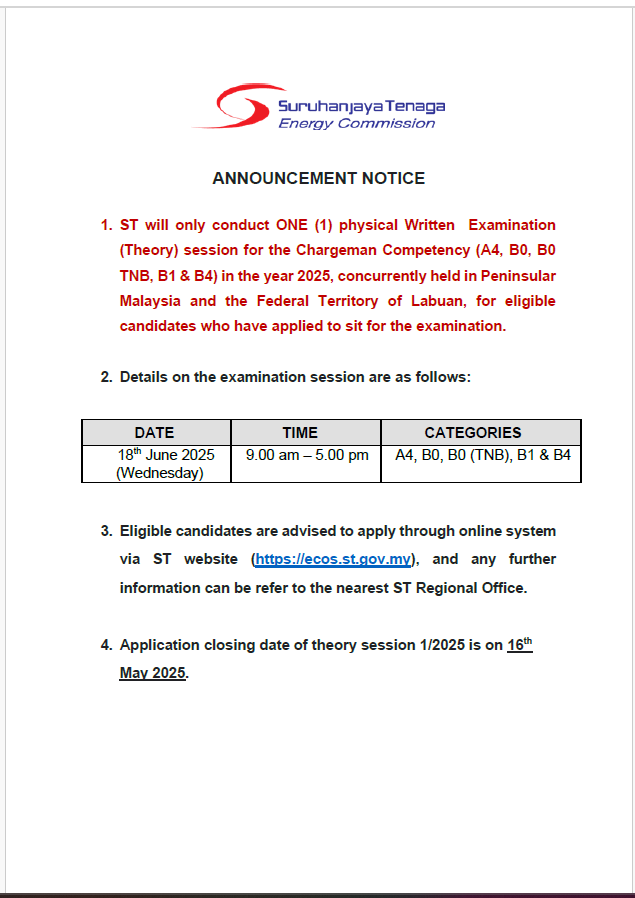

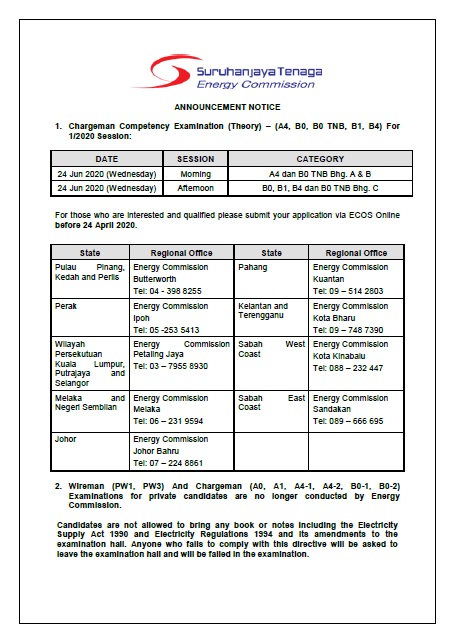

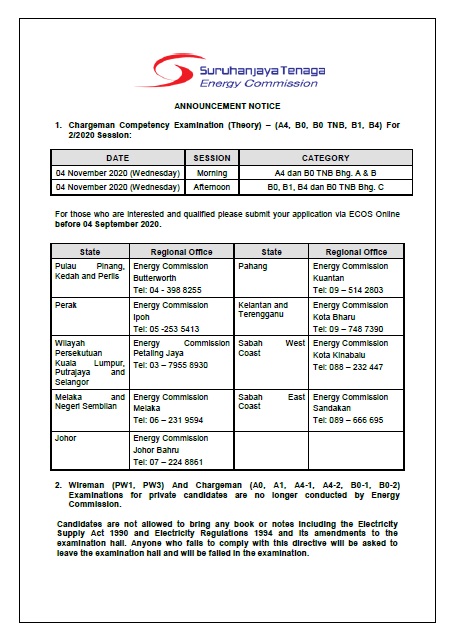

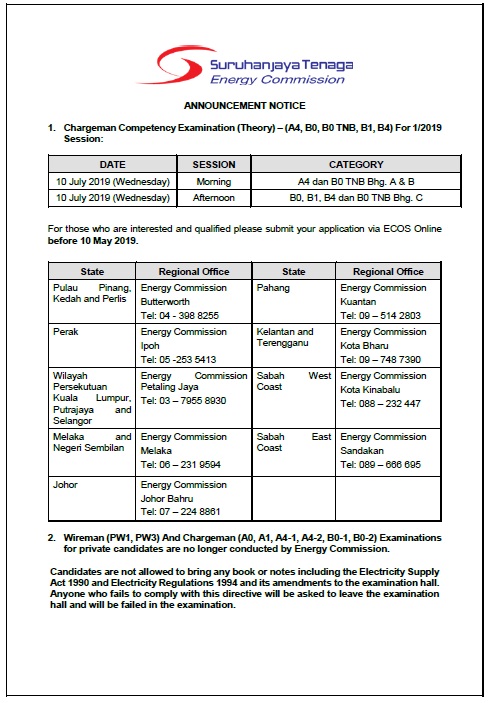

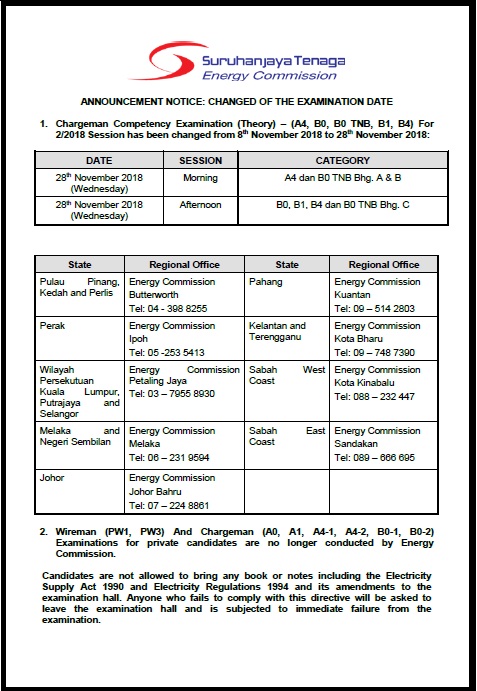

| 11 | Announcement Notice: Written Examination (Theory) session for the Chargeman Competency (A4, B0, B0 TNB, B1 & B4) | 03/02/2025 |

| 12 | "ST Seru Orang Ramai Utamakan Keselamatan Elektrik dan Gas di Musim Perayaan" | 28/01/2025 |

| 13 | PETRA Drives The Energy Agenda: Bridging Boundaries, Building Prosperity | 24/01/2025 |

| 14 | Outcome of ASEAN Special Senior Official’s Meeting on Energy on 22 January 2025 | 24/01/2025 |

| 15 | "Notis Makluman Pelaksanaan Program Bidaan Terbuka LSS PETRA 5+" | 17/01/2025 |

| 16 | "Portal MyEnergyStats ST: Gerbang Data Terbuka Sektor Tenaga Negara" | 16/01/2025 |

| 17 | "Pelaksanaan Caj Tunggu Sedia (Standby Charge) Terhadap Pengguna Bukan Domestik Yang Mempunyai Pepasangan Solar Fotovoltaik" | 31/12/2024 |

| 18 | "Pelantikan Pengerusi Suruhanjaya Tenaga (ST) Baharu" | 31/12/2024 |

| 19 | "Penguatkuasaan Akta Kecekapan dan Konservasi Tenaga 2024 [Akta 861] dan Peraturan-Peraturan Kecekapan dan Konservasi Tenaga 2024" | 31/12/2024 |

| 20 | "Program Green Electricity Tariff (GET) Diteruskan, Kadar Premium Dikekalkan Sehingga Disember 2025" | 28/12/2024 |

| 21 | "ST Seru Orang Ramai Utamakan Keselamatan Elektrik dan Gas di Musim Perayaan" | 24/12/2024 |

| 22 | "Progam Solar Untuk Kegunaan Sendiri Ditambah Baik Had Pemasangan Sistem Dimansuhkan dan Pemasangan Atas Tanah Serta Badan Air Dibenarkan" | 24/12/2024 |

| 23 | "Program Net Energy Metering (NEM) Ditambah Baik, Skim Insentif Solar Untuk Rakyat (SolaRIS) Dilanjutkan Untuk Galak Pemasangan Solar di Bumbung Bangunan" | 23/12/2024 |

| 24 | "Pengekalan Tarif Elektrik di Semenanjung: Kerajaan Menyediakan Subsidi Elektrik Sebanyak RM5.96 Bilion bagi Tempoh 1 Januari hingga 30 Jun 2025" | 20/12/2024 |

| 25 | Inaugural Malaysia-Singapore Cross-Border Renewable Energy Trade Set to Begin in December 2024 | 09/12/2024 |

| 26 | "Pewartaan Akta Kecekapan dan Konservasi Tenaga 2024" | 05/12/2024 |

| 27 | "Orang Ramai Diingat Utamakan Keselamatan Ketika dan Selepas Banjir" | 29/11/2024 |

| 28 | "Bidaan Pembangunan Sistem Penstoran Tenaga (BESS) Dibuka 29 November 2024 bagi Menyokong Aspirasi Peralihan Tenaga Negara" | 28/11/2024 |

| 29 | "EE Challenge 2024 Rekod Penjimatan Tenaga Terkumpul Sebanyak RM840,446 di Sekolah Sekitar Malaysia" | 28/11/2024 |

| 30 | "ST Lupuskan 4,386 Barangan Rampasan Bernilai Lebih RM250 Ribu di Klang" | 27/11/2024 |

| 31 | "ST Lupuskan 1,224 Barangan Rampasan Bernilai Lebih RM100 Ribu di Sabah" | 21/11/2024 |

| 32 | "ST Nasihat Orang Ramai Utamakan Keselamatan Elektrik dan Gas di Musim Perayaan" | 30/10/2024 |

| 33 | ST-ERIA-MASHRAE Align Objectives for Built Environment and Sustainability | 29/10/2024 |

| 34 | "ST Nasihat Orang Ramai Utamakan Keselamatan Elektrik dan Gas di Musim Banjir" | 16/10/2024 |

| 35 | Guidelines for the Corporate Renewable Energy Supply Scheme effective 20 September 2024 | 20/09/2024 |

| 36 | "ST Memperkasakan Kekompetenan TVET Sebagai Pemangkin Peralihan Tenaga Negara" | 26/08/2024 |

| 37 | "ST Lupuskan 139 Barangan Rampasan Bernilai Lebih RM10 Ribu di Sabah" | 22/08/2024 |

| 38 | Guidelines for the Approval of Electrical Equipment | 09/08/2024 |

| 39 | "Notis Pemberitahuan: Garis Panduan Pendawaian Elektrik Pepasangan Domestik (GPPEPD) Edisi 2024" | 07/08/2024 |

| 40 | Announcement Notice: Guideline For the Approval Of Electrical Equipment | 06/08/2024 |

| 41 | "CRESS Tingkatkan Akses Bekalan Elektrik Hijau bagi Syarikat Korporat di Malaysia" | 26/07/2024 |

| 42 | "ST Lupuskan 2,022 Barangan Rampasan Bernilai Lebih RM2 Juta Hasil Operasi Bitcoin Yang Melibatkan Kecurian Elektrik serta Kelengkapan Elektrik Tanpa Label Keselamatan ST-SIRIM" | 12/07/2024 |

| 43 | "Tiada Kenaikan Tarif Elektrik di Semenanjung bagi Tempoh 1 Julai hingga 31 Disember 2024" | 29/06/2024 |

| 44 | Energy Exchange Malaysia (ENEGEM) Established for Cross-Border Sales of Green Electricity to Singapore | 15/04/2024 |

| 45 | "Pemeteraian Memorandum Persefahaman (MoU) Antara Suruhanjaya Tenaga dan SME Corp. Malaysia" | 21/03/2024 |

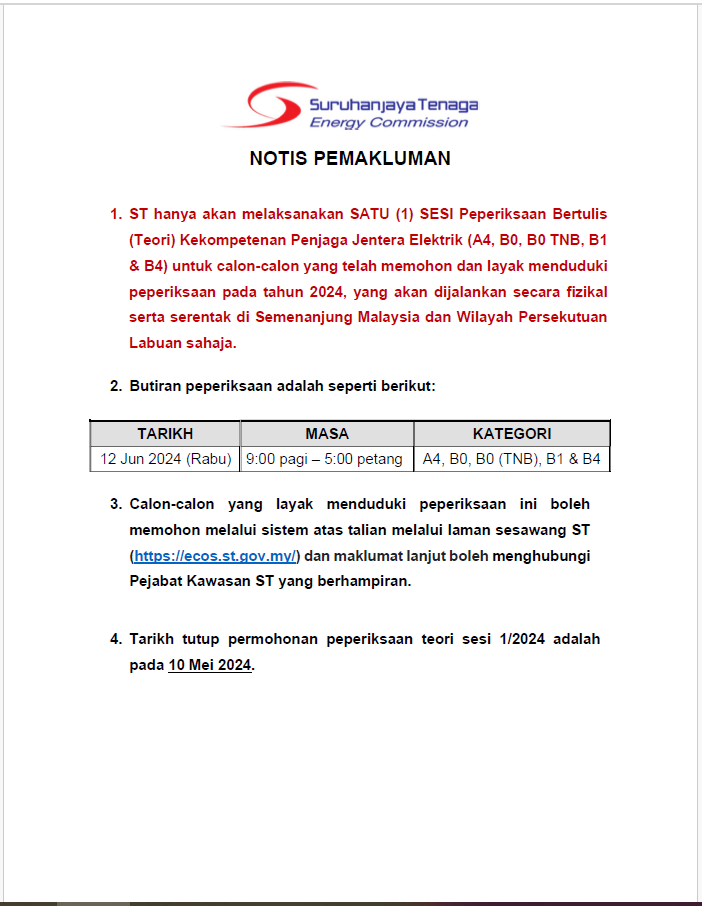

| 46 | "Notis Pemakluman Peperiksaan Teori Sesi 1/2024" | 23/02/2024 |

| 47 | "ST Seru Orang Ramai Utamakan Keselamatan Elektrik dan Gas di Musim Perayaan" | 08/02/2024 |

| 48 | "Pemakluman Perubahan Nama Kementerian Peralihan Tenaga dan Daya Guna Awam (KPTDGA) kepada Kementerian Peralihan Tenaga dan Transformasi Air (PETRA)" | 08/02/2024 |

| 49 | "ST Siasat Kes Kebakaran Stesen Pengecas Kenderaan Elektrik (EVCS) Premis Pusat Pameran Kereta di Johor Bahru" | 11/01/2024 |

| 50 | "Kuasa Pengawalseliaan Pembekalan Elektrik Sabah Diserah kepada Energy Commission of Sabah (ECoS) Mulai 3 Januari 2024" | 05/01/2024 |

| 51 | (PUBLIC COMMENT) Draft MS 60475:202X Method of Sampling Insulating Liquids | 05/01/2024 |

| 52 | (PUBLIC COMMENT) Draft MS 60296:202X Fluids for Electrotechnical Applications - Mineral Insulating Oils for Electrical Equipment | 05/01/2024 |

| 53 | (PUBLIC COMMENT) Draft MS 2799:202X Water Dispenser For Household Use - Method of Measuring The Performance | 05/01/2024 |

| 54 | "99% Pengguna Domestik Di Kulim Hi-Tech Park, Kedah Tidak Terjejas Dengan Pelarasan Tarif Elektrik Bagi Tempoh 1 Januari Hingga 30 Jun 2024" | 26/12/2023 |

| 55 | "99% Pengguna Domestik Di Sabah Dan Wilayah Persekutuan Labuan Tidak Terjejas Dengan Pelarasan Tarif Elektrik Bagi Tempoh 1 Januari Hingga 30 Jun 2024" | 26/12/2023 |

| 56 | "85% Pengguna Domestik Di Semenanjung Tidak Terjejas Dengan Pelarasan Tarif Elektrik Bagi Tempoh 1 Januari-30 Jun 2024" | 22/12/2023 |

| 57 | "TNB Akan Dipanggil untuk Beri Keterangan Berkenaan Kes Kemalangan Elektrik di Bayan Lepas, Pulau Pinang" | 23/11/2023 |

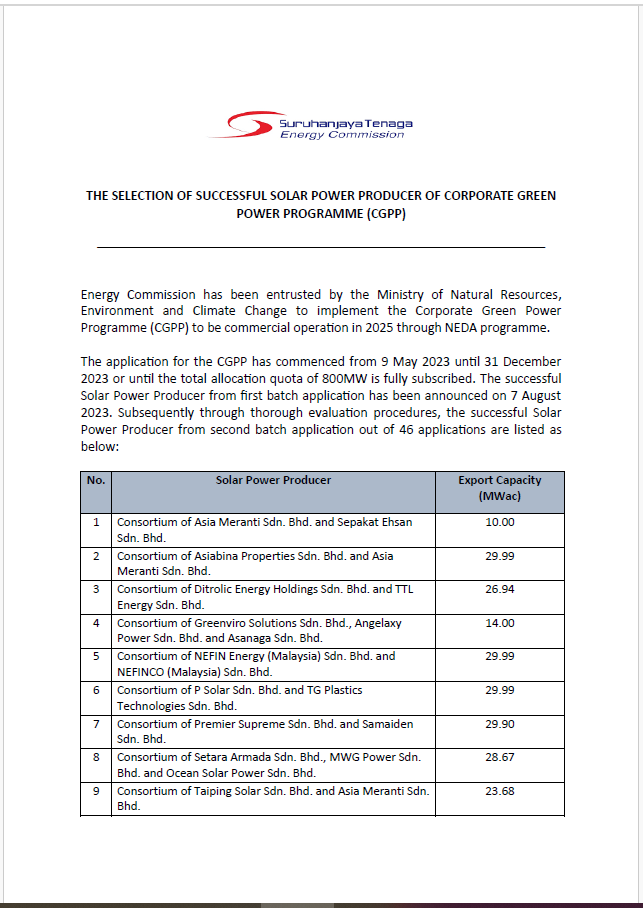

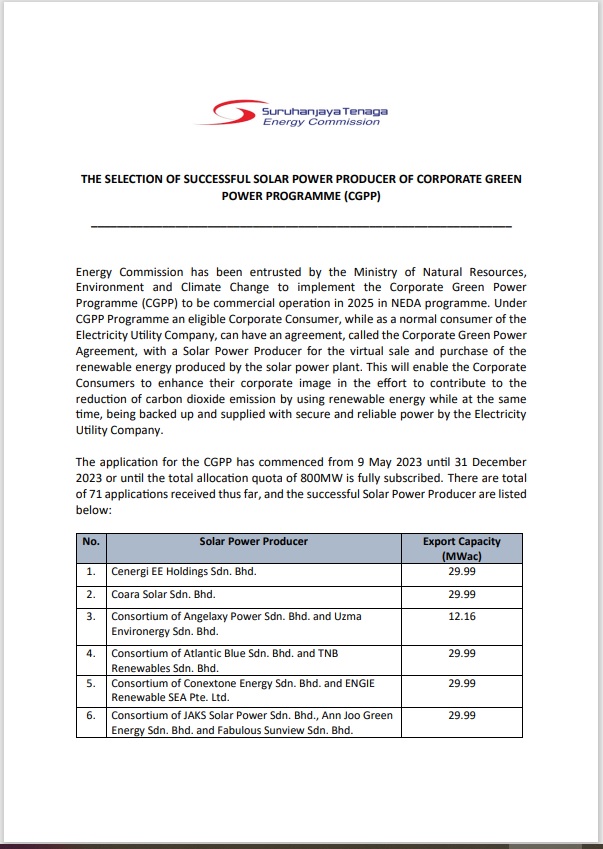

| 58 | The Selection of Successful Solar Power Producer of Corporate Green Power Programme (CGPP) (Second Batch) | 08/11/2023 |

| 59 | "Pemakluman Tarikh Perlaksanaan Minimum Energy Performance Standard (MEPS) bagi Kelengkapan Ketuhar Elektrik (Electric Oven)" | 08/11/2023 |

| 60 | "ST Siasat Kes Kemalangan Maut Renjatan Elektrik di Taman Bercham Raya, Ipoh" | 30/10/2023 |

| 61 | (PUBLIC COMMENT) DRAFT MS ISO/IEC TR 63306-1:202X Smart manufacturing standards map (SM2) – Part 1: Framework (ISO/IEC TR 63306-1:2020, IDT) | 11/09/2023 |

| 62 | (PUBLIC COMMENT) DRAFT MS IEC 62793-2020 Thunderstorm warning systems – Protection against lightning | 11/09/2023 |

| 63 | 12 Malaysian Sustainable Energy Projects Win The ASEAN Energy Awards | 28/08/2023 |

| 64 | "Notis Makluman Peperiksaan Bertulis Orang Kompeten Gas" | 23/08/2023 |

| 65 | Additional Information on CGPP Application | 22/08/2023 |

| 66 | "ST Terima Pengiktirafan Anugerah Brandlaureate Bestbrands 2022-2023 " | 17/08/2023 |

| 67 | NEA 2023 Recognises 29 for Commendable Sustainability Efforts, 23 Winners to Compete at the ASEAN Energy Awards | 17/08/2023 |

| 68 | "NEA 2023 Iktiraf 29 atas Usaha Kemampanan, 23 Pemenang akan Bersaing untuk Anugerah Tenaga ASEAN" | 17/08/2023 |

| 69 | Immediate Opportunity to Reduce Scope 2 Emissions and Be RE100 | 10/08/2023 |

| 70 | The Selection of Successful Solar Power Producer of Corporate Green Power Programme (CGPP) | 07/08/2023 |

| 71 | "Langganan Program Green Electricity Tariff (GET) Akan Dibuka Pada 11 Ogos 2023" | 07/08/2023 |

| 72 | "ST Nasihat Utamakan Keselamatan Elektrik Semasa Kempen PRU DUN ke-15" | 02/08/2023 |

| 73 | "Notis Pemberitahuan: Peperiksaan Bertulis (Teori) Kekompetenan Penjaga Jentera Elektrik Sesi 2/2023 " | 31/07/2023 |

| 74 | "Syarikat Didenda RM20,000.00 atas Kesalahan Curi Elektrik bagi Kegunaan Mesin Bitcoin" | 27/07/2023 |

| 75 | International Business Review (Edition 151): ST CEO on "ST Spearheading Malaysia's Transition to Net Zero" | 12/07/2023 |

| 76 | "Permohonan Pelantikan Peguam Panel Suruhanjaya Tenaga" | 07/07/2023 |

| 77 | "Pelarasan Tarif Elektrik di Kulim Hi-Tech Park bagi Tempoh 1 Julai - 31 Disember 2023 | 30/06/2023 |

| 78 | "Pelarasan Tarif Elektrik di Sabah dan WP Labuan bagi Tempoh 1 Julai - 31 Disember 2023" | 28/06/2023 |

| 79 | "ST Siasat Kes Kebakaran di Pencawang Elektrik Midvalley Megamall" | 19/05/2023 |

| 80 | "KERTAS KONSULTASI AWAM - PERUNTUKAN KUASA PENGAWALSELIAAN KEPADA ST BERHUBUNG DENGAN AKTIVITI IMPORT & EKSPORT TENAGA ELEKTRIK KE LUAR SEMPADAN MALAYSIA DI BAWAH AKTA BEKALAN ELEKTRIK [AKTA 447] & AKTA ST [AKTA 610]" | 17/05/2023 |

| 81 | "ST Nasihat Orang Ramai Utamakan Keselamatan Elektrik dan Gas di Musim Perayaan" | 19/04/2023 |

| 82 | Guide for Corporate Green Power Programme (CGPP) | 17/04/2023 |

| 83 | The Energy Commission’s Statement in Response to The Star’s Article on 8 April 2023 Titled: Short Position: Green Power Poser | 10/04/2023 |

| 84 | "Penambahan Kuota di bawah Program Tenaga Hijau Korporat (CGPP)" | 14/03/2023 |

| 85 | "Pelarasan Tarif Elektrik di Sabah dan Wilayah Persekutuan Labuan bagi Tempoh 1 Januari 2023 Hingga 30 Jun 2023" | 28/12/2022 |

| 86 | "Pelarasan Tarif Elektrik di Kulim Hi-Tech Park, Kedah bagi Tempoh 1 Januari 2023 Hingga 30 Jun 2023" | 28/12/2022 |

| 87 | "Pelarasan Tarif Asas Kemudahan Gas untuk Tempoh Kawal Selia Kedua (RP2: 2023 – 2025) dan Pelarasan Pendapatan Serta Purata Tarif bagi Tahun 2023" | 27/12/2022 |

| 88 | Registered Electrical Contractor | 21/12/2022 |

| 89 | "Pelarasan Tarif Elektrik di Semenanjung bagi Tempoh 1 Januari 2023 hingga 30 Jun 2023" | 16/12/2022 |

| 90 | "Program Tenaga Hijau Korporat Sokong Agenda Pembangunan Ekonomi Hijau Negara" | 31/10/2022 |

| 91 | Individual Found Guilty of Electricity Theft for Bitcoin Mining Activities Fined RM20,000.00 | 21/10/2022 |

| 92 | ST Seizes Bitcoin Machines Worth Over RM2 Million in An OPS RENJAT Integrated Operation | 07/10/2022 |

| 93 | ST Investigates the Electrical Accident Case in Kampung Teras Jernang, Selangor | 05/10/2022 |

| 94 | "Tarif Elektrik Bagi Pengguna di Semenanjung Malaysia Kekal" | 27/06/2022 |

| 95 | "Surat Pemakluman Tarikh Penguatkuasaan Kepada Pengimport dan Pengilang - 31 Mei 2022 " | 17/06/2022 |

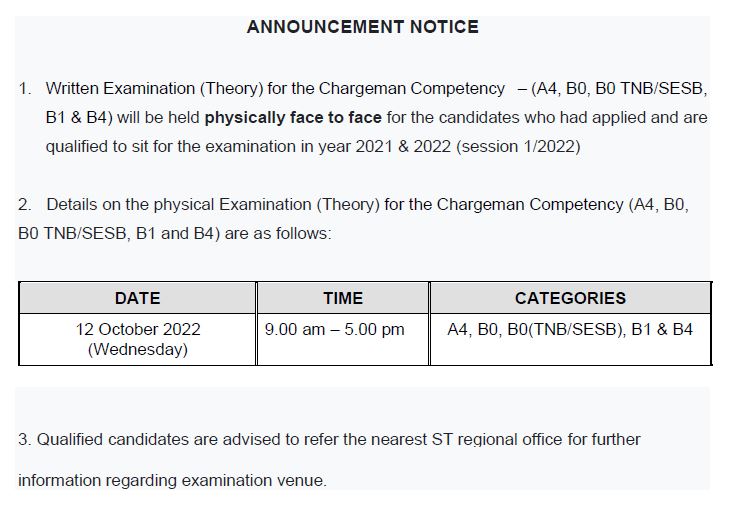

| 96 | Announcement Notice for Written Examination (Theory) | 05/04/2022 |

| 97 | “Tiada Kenaikan Tarif Elektrik di Sabah dan Wilayah Persekutuan Labuan di Bawah Pelaksanaan Mekanisme Incentive-Based Regulation bagi Tempoh Kawal Selia Pertama (RP1: 2022 – 2024)” | 31/01/2022 |

| 98 | "Pelarasan Tarif Elektrik Mulai 1 Februari 2022 - 31 Disember 2024 bagi Tempoh Kawal Selia Kedua (RP2: 2022 – 2024) dan Pelarasan Mekanisme Imbalance Cost Pass-Through (ICPT) bagi Tempoh 1 Februari hingga 30 Jun 2022 di Kulim Hi-Tech Park, Kedah" | 31/01/2022 |

| 99 | "Tiada Kenaikan Tarif Elektrik Bagi Pengguna-Pengguna Domestik di Semenanjung Malaysia" | 28/01/2022 |

| 100 | Program Sustainability Achieved via Energy Efficiency (SAVE) 3.0 | 11/01/2022 |

| 101 | "Kenyataan Media - Tarif Elektrik di Semenanjung Kekal" | 01/01/2022 |

| 102 | "Pengumuman tarikh akhir bagi pelaksanaan di bawah Notis Berhubung Dengan Pemegang Lesen Peruncitan bagi Sektor Komersial, Sektor Kediaman dan Pengguna LPG" | 10/12/2021 |

| 103 | Frequently Asked Questions on Aduan (FAQ Aduan) | 02/11/2021 |

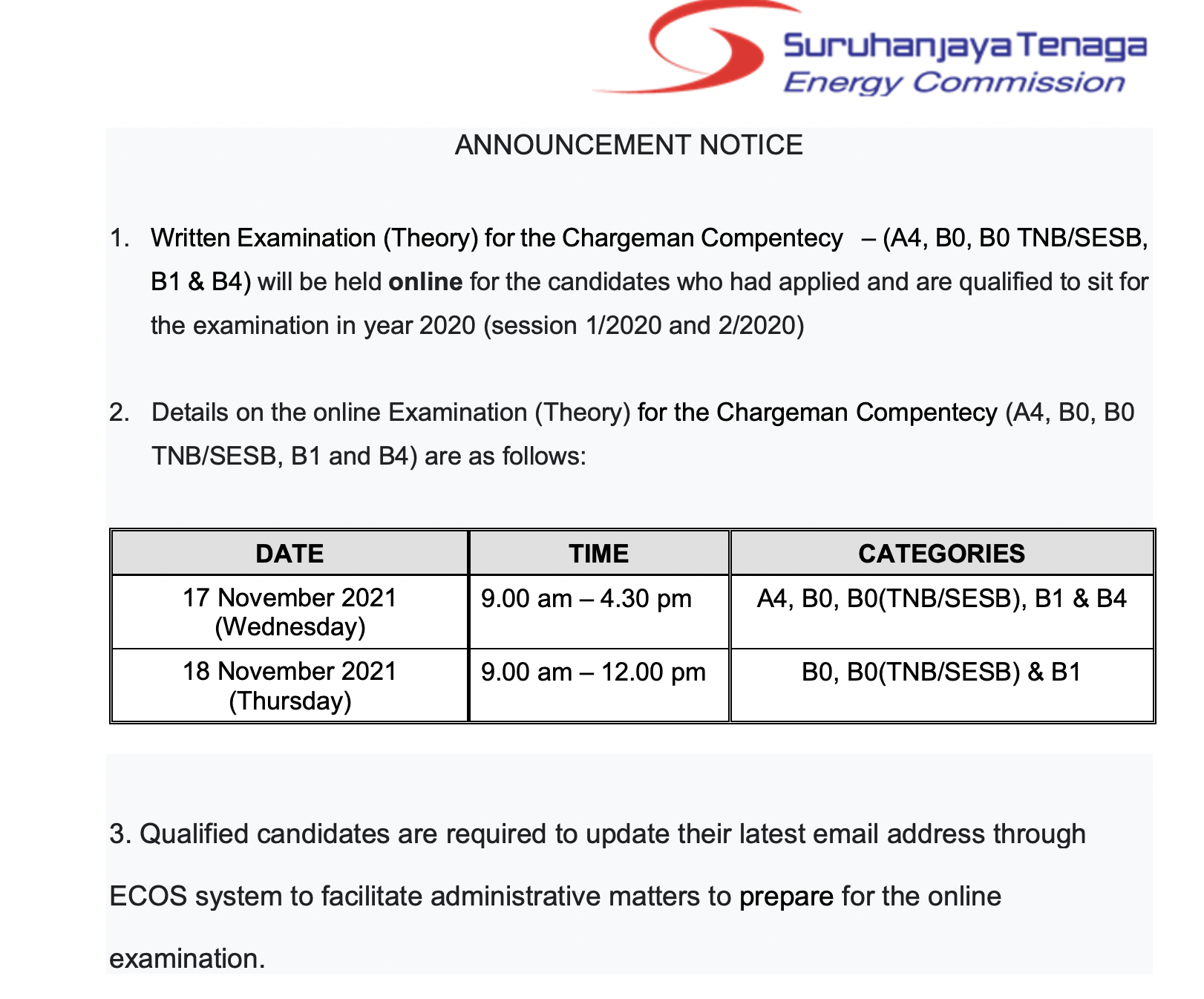

| 104 | Written Examination Announcement Notice | 27/07/2021 |

| 105 | "Kenyataan Media - Kadar Rebat Elektrik Kekal 2 Sen Setiap Kilowatt Jam kepada Semua Pengguna di Semenanjung Malaysia bagi Tempoh 1 Julai 2021 hingga 31 Disember 2021" | 02/07/2021 |

| 106 | "Kenyataan Media - Kadar Rebat Elektrik 2 Sen Setiap Kilowatt Jam kepada Pengguna Bukan Domestik di KHTP bagi Tempoh 1 Julai 2021 hingga 31 Disember 2021" | 02/07/2021 |

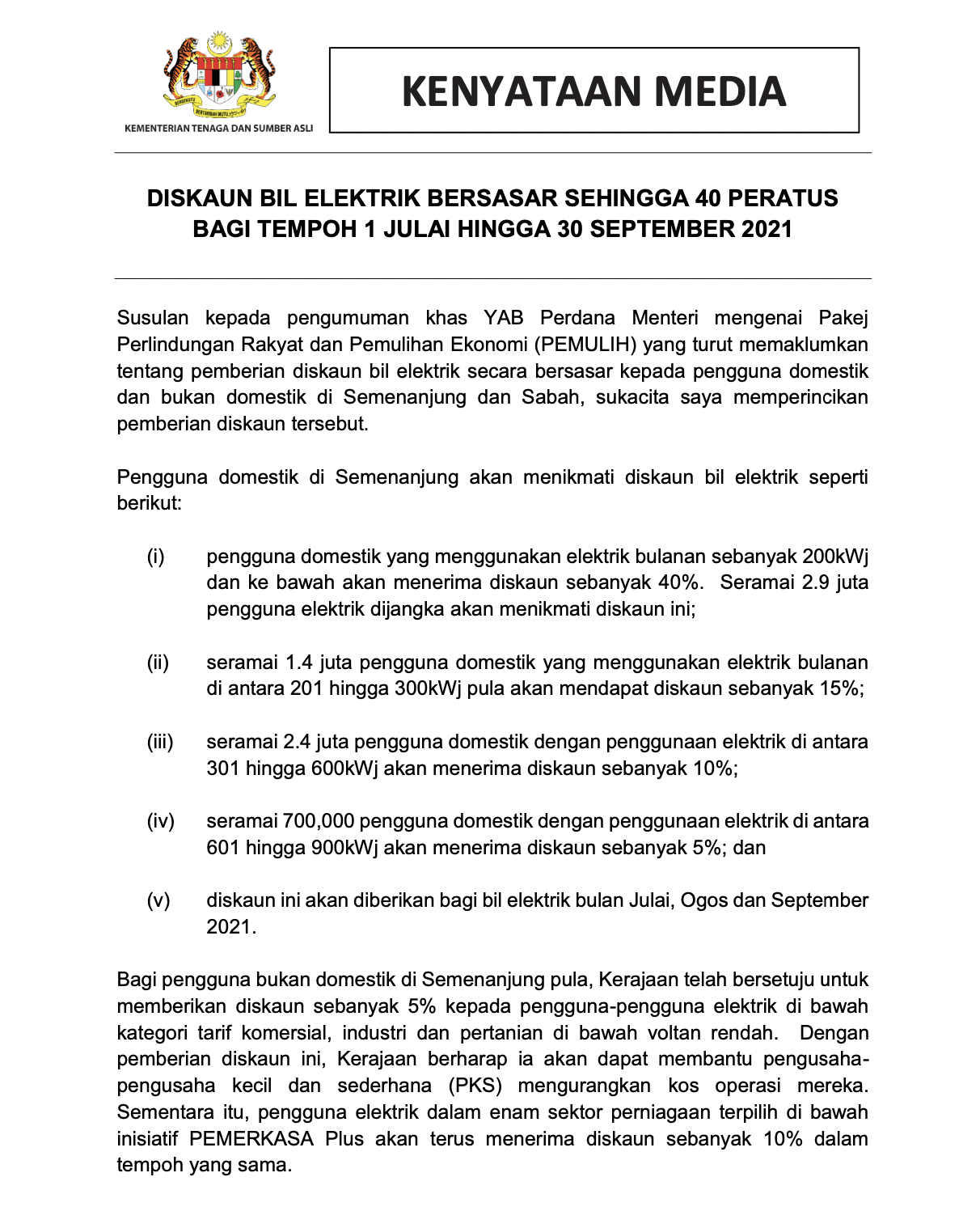

| 107 | "Diskaun Bil Elektrik Bersasar sehingga 40 Peratus bagi Tempoh 1 Julai hingga 30 September 2021" | 29/06/2021 |

| 108 | Guidelines for Solar Photovoltaic Installation Under Net Offset Virtual Aggregations (NOVA) Programme for Peninsular Malaysia | 01/04/2021 |

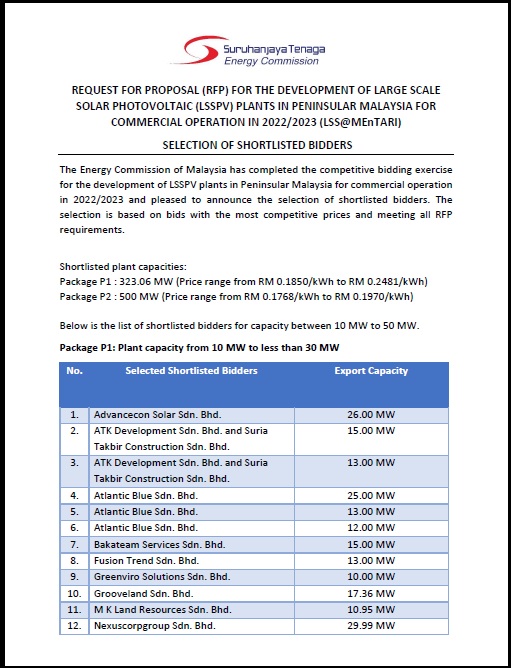

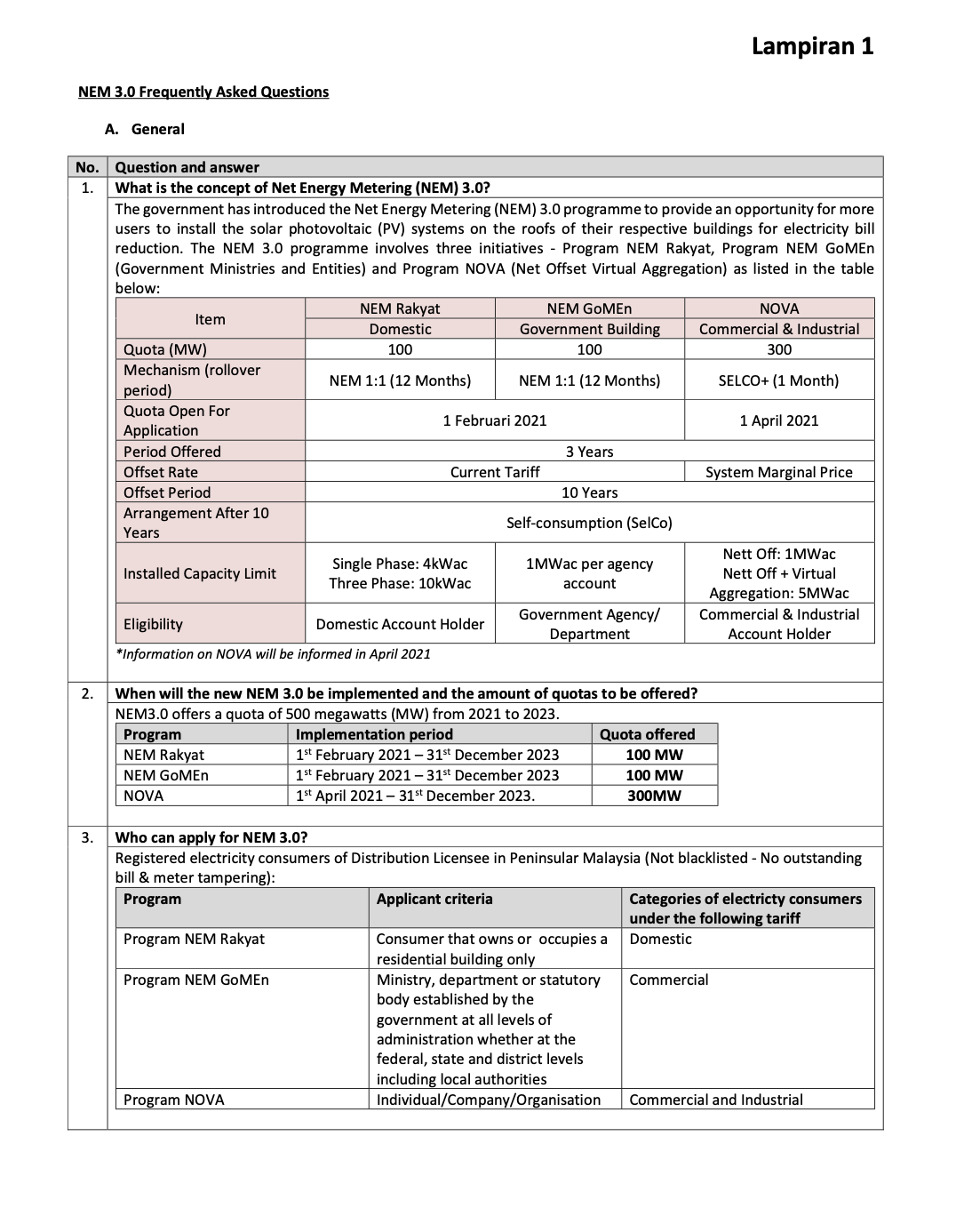

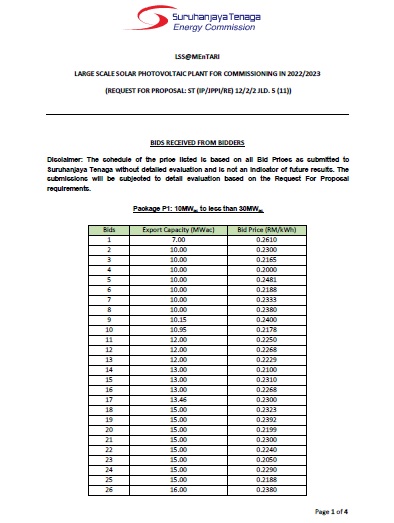

| 109 | Announcement of the Selected Shortlisted Bidders for LSS@MEnTARI | 12/03/2021 |

| 110 | FAQ on NEM Rakyat & NEM GoMEn | 16/02/2021 |

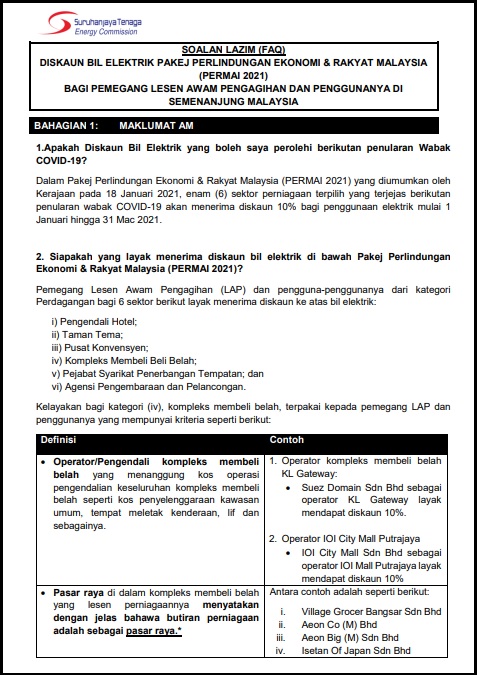

| 111 | Guidelines for Solar Photovoltaic Installation under the Programme of NEM Rakyat and NEM GoMEn in Peninsular Malaysia | 30/01/2021 |

| 112 | "Diskaun Bil Elektrik Pakej Perlindungan Ekonomi & Rakyat Malaysia (PERMAI 2021)" | 27/01/2021 |

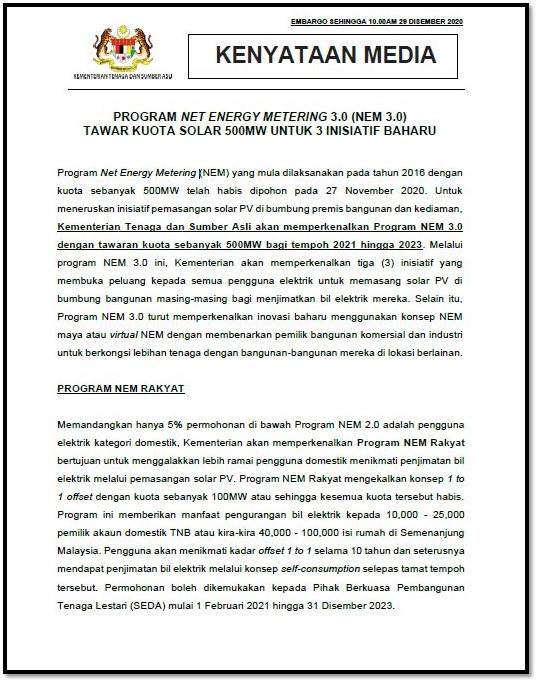

| 113 | (Infographic) "Tips Keselamatan Elektrik di Musim Banjir" | 15/01/2021 |

| 114 | "Program Net Energy Metering 3.0 (NEM 3.0) Tawar Kuota Solar 500MW untuk 3 Inisiatif Baharu" | 29/12/2020 |

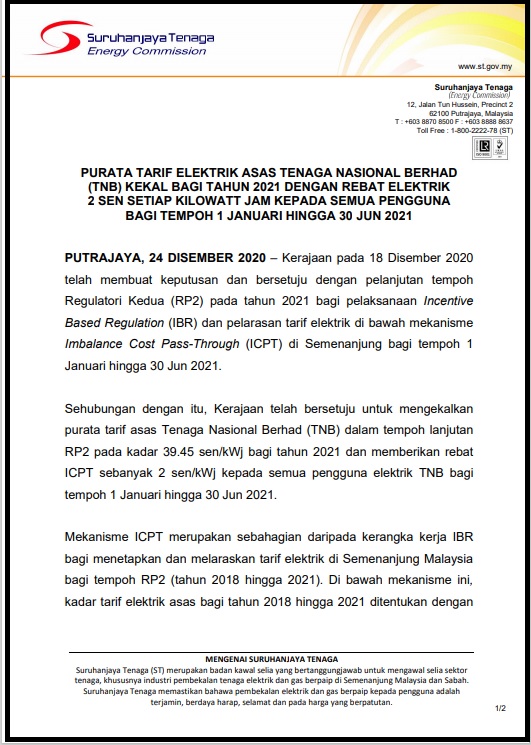

| 115 | "ST Lanjut Tempoh Tarif IBR RP2 dan ICPT Jan-Jun 2021 di Semenanjung" | 24/12/2020 |

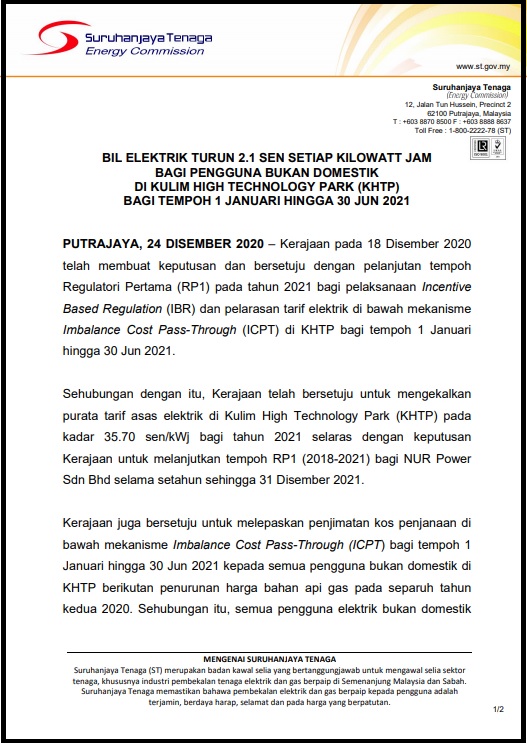

| 116 | "ST Lanjut Tempoh Tarif IBR RP1 dan ICPT Jan-Jun 2010 di KHTP" | 24/12/2020 |

| 117 | "Notis Purata Harga Jualan Gas Asli kepada Pelanggan Gas Malaysia Energy & Services Sdn Bhd (GMES)" | 19/12/2020 |

| 118 | LSS@MEnTARI - Large Scale Solar Photovoltaic Plant for Commissioning in 2022/2023 | 28/10/2020 |

| 119 | Pemakluman Permohonan Peperiksaan | 16/09/2020 |

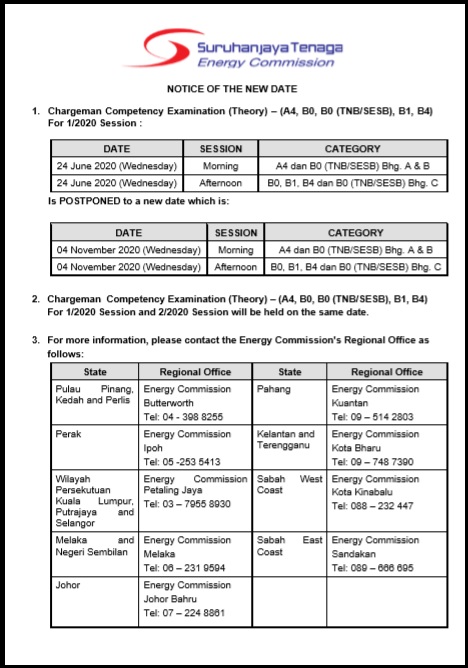

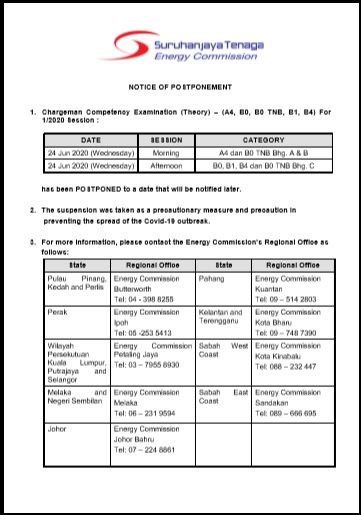

| 120 | Notice on Exam Postponement | 22/07/2020 |

| 121 | "Tiada Surcaj Dikenakan Kepada Pengguna Bukan Domestik Dan Pengguna Domestik Bagi Tempoh 1 Julai 2020 – 31 Disember 2020" | 30/06/2020 |

| 122 | "Notis Makluman Pelaksanaan Program Bidaan Kompetitif bagi Pembangunan Loji Janakuasa Solar PV Berskala Besar (LSS) di Semenanjung Malaysia" | 30/05/2020 |

| 123 | Notice of Postponement (Exam) | 26/05/2020 |

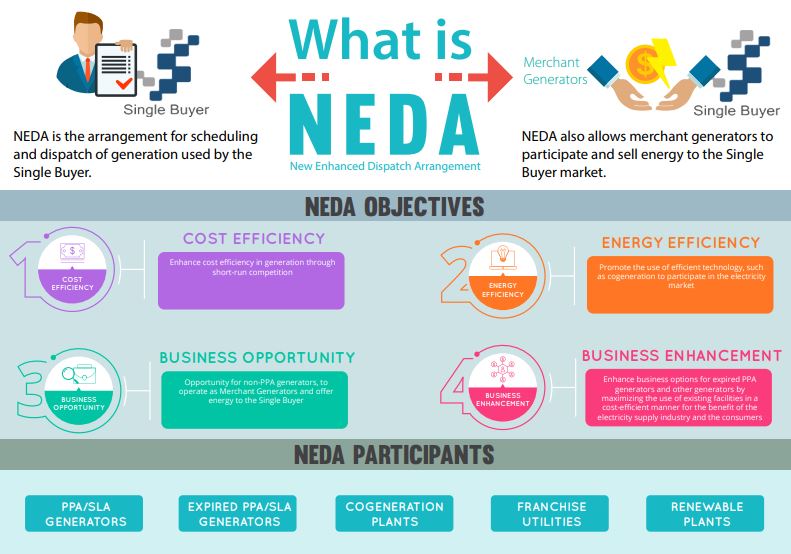

| 124 | What is New Enhanced Dispatch Arrangement (NEDA) ? | 20/05/2020 |

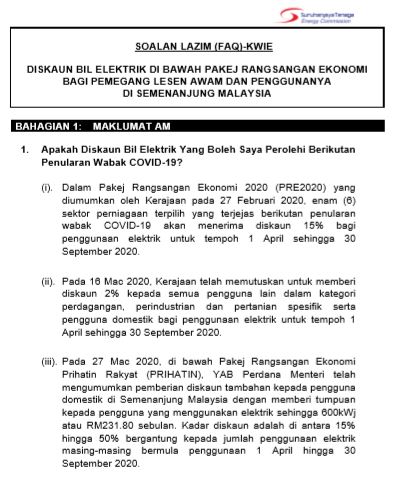

| 125 | "FAQ (Infografik) bagi Tuntutan Kos Diskaun Bil Elektrik Di Bawah Pakej Rangsangan Ekonomi" | 23/04/2020 |

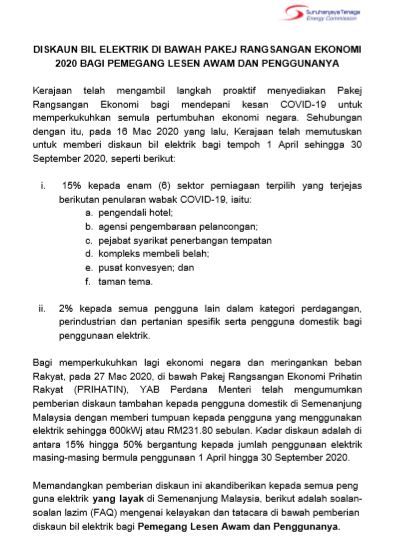

| 126 | "FAQ - Diskaun Bil Elektrik Di Bawah Pakej Rangsangan Ekonomi 2020 Bagi Pemegang Lesen Awam dan Penggunanya" | 02/04/2020 |

| 127 | "Diskaun Bil Elektrik Di Bawah Pakej Rangsangan Ekonomi 2020 Bagi Pemegang Lesen Awam dan Penggunanya" | 02/04/2020 |

| 128 | Report on Peninsular Malaysia Generation Development Plan 2019 (2020 - 2030) | 25/02/2020 |

| 129 | "Peperiksaan Kekompetenan Penjaga Jentera Bagi Sesi 1/2020" | 10/01/2020 |

| 130 | "Peperiksaan Kekompetenan Penjaga Jentera Bagi Sesi 2/2020" | 10/01/2020 |

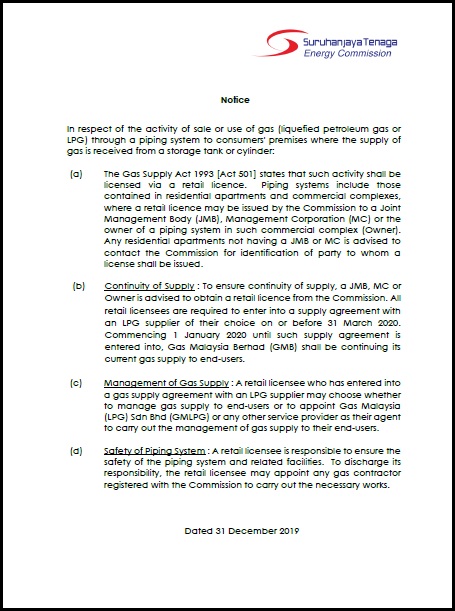

| 131 | Notice Regarding Retail Licensee for LPG Customers | 31/12/2019 |

| 132 | Notice Regarding Retail Licensee for Commercial Sector | 31/12/2019 |

| 133 | Notice Regarding Retail Licensee for Residential Sector | 30/12/2019 |

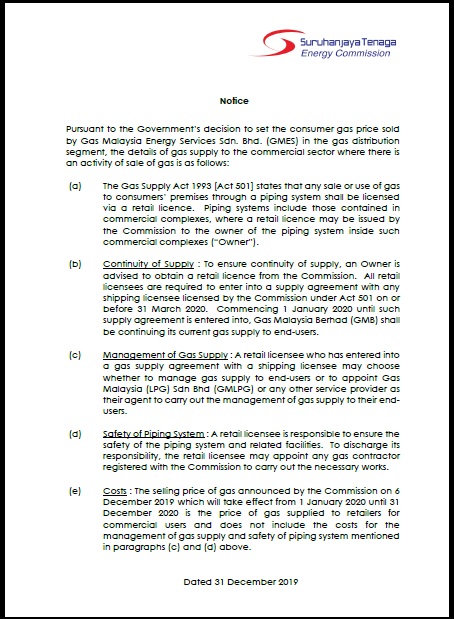

| 134 | Announcement of Shortlisted Bidders for the Development of Large Scale Solar Photovoltaic (LSSPV) Plants for Commercial Operation in Peninsular Malaysia, 2021 | 23/12/2019 |

| 135 | Notice to Market on Gas Distribution Segment Way Forward | 20/12/2019 |

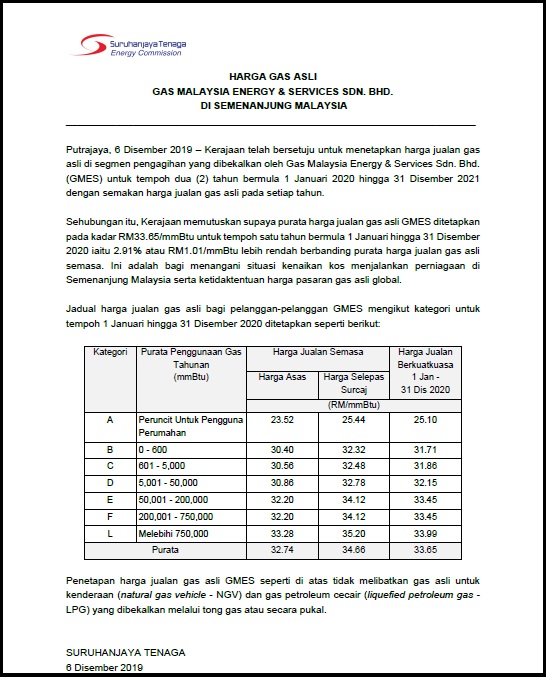

| 136 | "Tarif Elektrik Pengguna Domestik Kekal dan Kadar Surcaj Tarif Elektrik Turun Bagi Pengguna Bukan Domestik Di Semenanjung Malaysia" | 06/12/2019 |

| 137 | Notice of Energy Commission’s Statement on Gas Malaysia Energy & Services Sdn. Bhd Natural Gas Selling Price in Peninsular Malaysia | 06/12/2019 |

| 138 | Large Scale Solar (LSS) Photovoltaic Plants for 2021 - Bid Opening Price | 26/08/2019 |

| 139 | Energy Commission Appoints New CEO | 08/08/2019 |

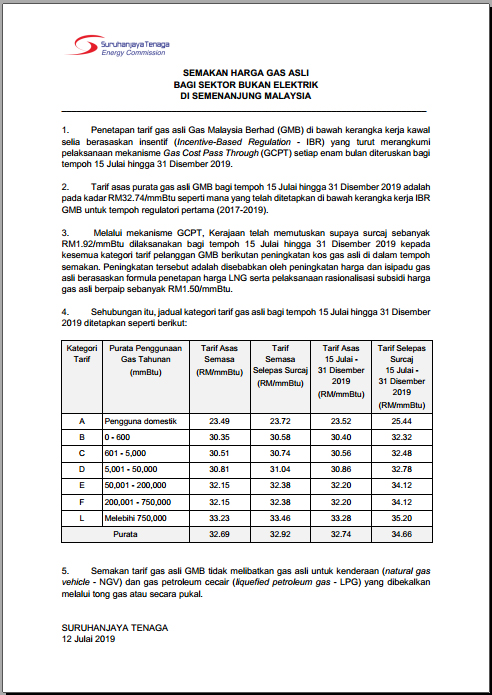

| 140 | "ST Tahan TV LED Import Guna Label Keselamatan Yang Tidak Sah" | 18/07/2019 |

| 141 | Media Statement: The Energy Commission’s Statement on Natural Gas Price Review for Non-Electricity Sector in Peninsular Malaysia, 12 July 2019 | 12/07/2019 |

| 142 | Media Statement: "Pelarasan Tarif Elektrik Di Semenanjung Malaysia Bagi Tempoh 1 Julai 2019 - 31 Disember 2019" | 28/06/2019 |

| 143 | "Notis Pemasangan Gas Berpaip di Bangunan Berketinggian 40 tingkat Ke Atas" | 12/03/2019 |

| 144 | Announcement Notice: Examination for 1/2019 | 26/02/2019 |

| 145 | Energy Efficiency Challenge 2019 | 14/02/2019 |

| 146 | Notice for Open Competitive Bidding Program for the Development of Large Scale Solar (LSS) Photovoltaic Plant in Peninsular Malaysia | 14/02/2019 |

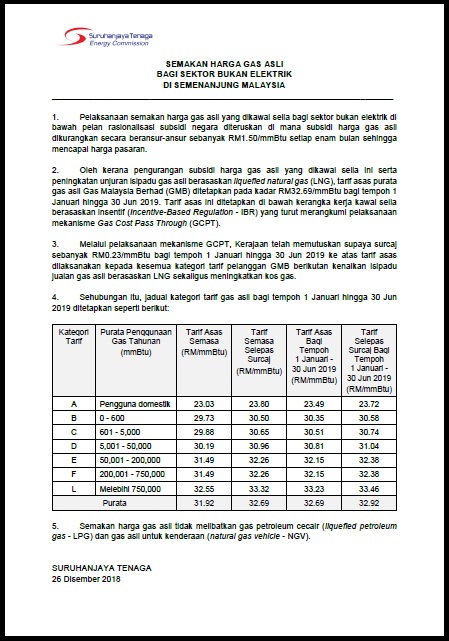

| 147 | "Semakan Harga Gas Asli Bagi Sektor Bukan Elektrik Di Semenanjung Malaysia" | 26/12/2018 |

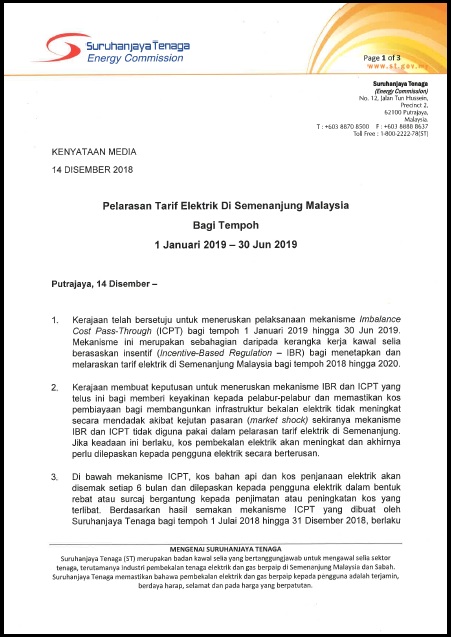

| 148 | "Pelarasan Tarif Elektrik Di Semenanjung Malaysia Bagi Tempoh 1 Januari 2019 - 30 Jun 2019" | 14/12/2018 |

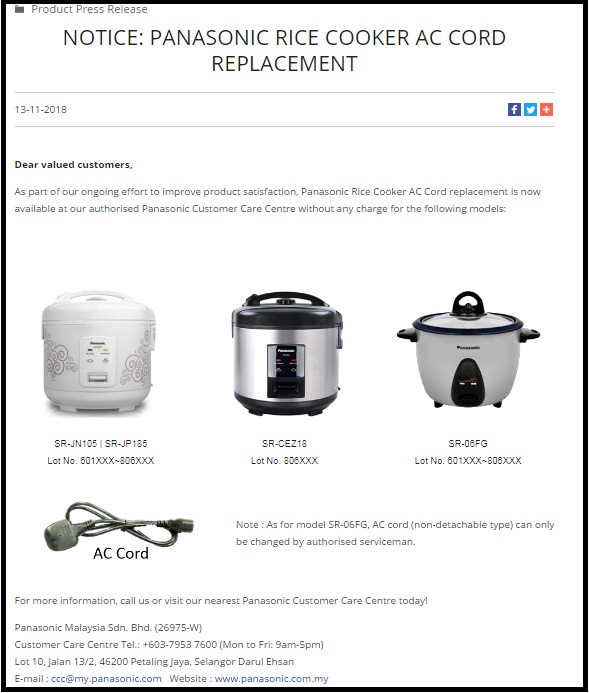

| 149 | Notice of Panasonic Rice Cooker AC Cord Replacement | 10/12/2018 |

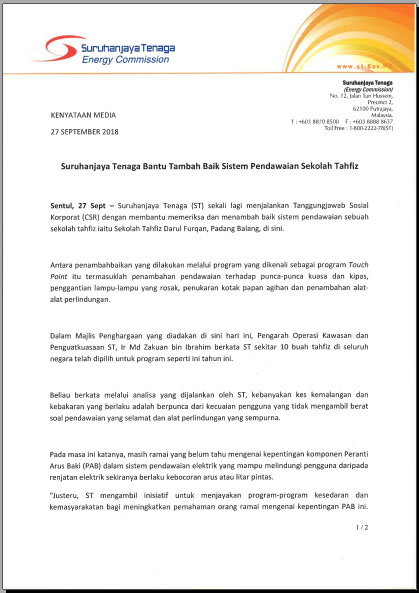

| 150 | Announcement Notice : Changed of Examination Date | 08/11/2018 |

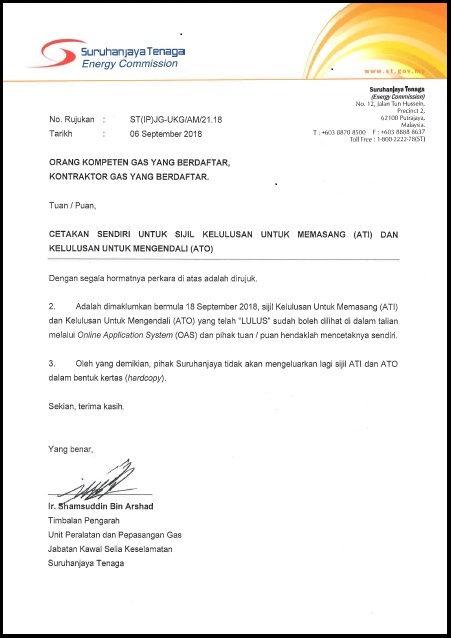

| 151 | "Kenyataan Media: Suruhanjaya Tenaga Bantu Tambah Baik Sistem Pendawaian Sekolah Tahfiz" | 01/10/2018 |

| 152 | "Cetakan Sendiri untuk Sijil Kelulusan untuk Memasang (ATI) dan Kelulusan untuk Mengendali (ATO)" | 13/09/2018 |

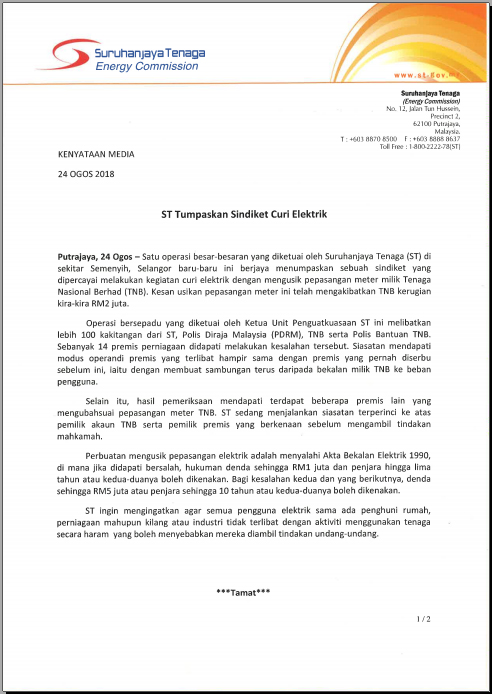

| 153 | "Kenyataan Media: ST Tumpaskan Sindiket Curi Elektrik" | 27/08/2018 |

| 154 | "Kenyataan Media: ST Terbitkan Dua Lagi Buku Berkaitan Industri Tenaga" | 17/08/2018 |

| 155 | Media Statement: "Perusahaan Dobi Perlu Dapatkan Kelulusan dan Lesen dari ST" | 19/07/2018 |

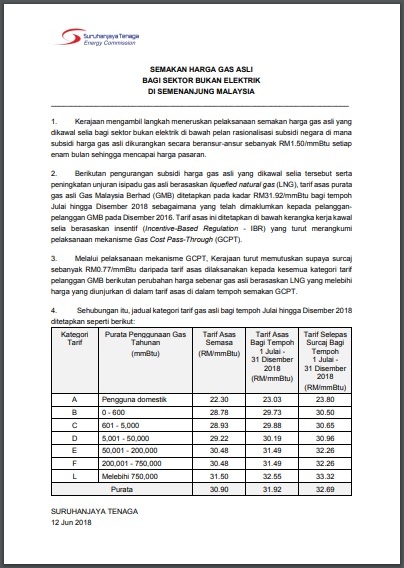

| 156 | "Pelarasan Tarif Elektrik di Semenanjung, Sabah dan Wilayah Persekutuan Labuan bagi Melepaskan Kos Tak Berimbang (Imbalance Cost Pass-Through) untuk Tempoh 1 Julai 2018 – 31 Disember 2018" | 29/06/2018 |

| 157 | The Energy Commission’s Statement on Natural Gas Price Review for Non-Electricity Sector in Peninsular Malaysia | 13/06/2018 |

| 158 | Media Statement: “ST Serbu Kilang Usik Pepasangan Meter Milik TNB” | 12/06/2018 |

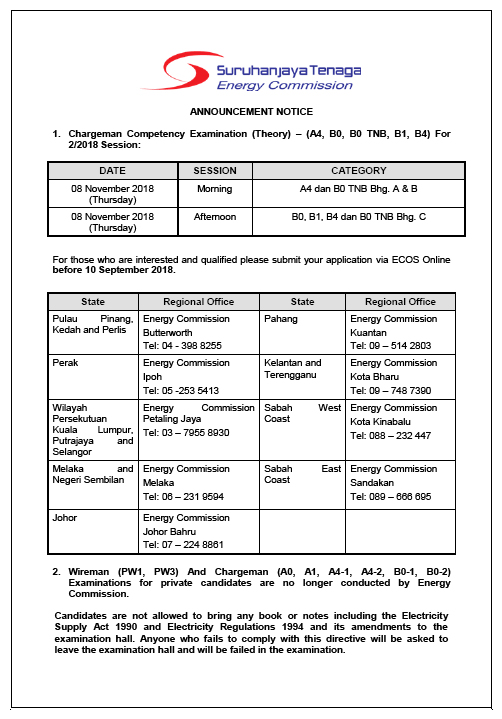

| 159 | "Ketua Unit Pembangunan Keselamatan Elektrik Suruhanjaya Tenaga, Iffah Hannah Muluk berkongsi mengenai Keselamatan Elektrik di Musim Perayaan melalui rancangan Selamat Pagi Malaysia, TV1" | 08/06/2018 |

| 160 | Announcement Notice on Examination for Chargeman | 06/06/2018 |

| 161 | Media Statement: "ST Rampas Kelengkapan Elektrik Tidak Selamat Bernilai Lebih RM300,000" | 05/06/2018 |

| 162 | Media Statement: "Dapur Gas Domestik Hendaklah Mendapatkan Kelulusan ST dan Label SIRIM" | 30/05/2018 |

| 163 | Electrical Equipment Recall Notice | 18/05/2018 |

| 164 | Media Statement: "ST Nasihat Orang Ramai Utama Keselamatan Elektrik Ketika Berkempen" | 26/04/2018 |

| 165 | ST Publishes Malaysia Energy Statistics Handbook 2017 | 26/04/2018 |

| 166 | "Notis Penangguhan Tarikh Kuatkuasa Perlaksanaan Arahan Mengemukakan No. Siri Kelengkapan Elektrik Bagi Setiap Batch Konsainmen Semasa Ujian Konsainmen SIRIM" | 18/04/2018 |

| 167 | Media Statement: "Prestasi Bekalan Elektrik di Sabah Bertambah Baik" | 10/04/2018 |

| 168 | Electricity Tariff Review in Peninsular Malaysia for Regulatory Period 2 (RP2: 2018 – 2020) under Incentive-Based Regulation Mechanism | 10/04/2018 |

| 169 | Media Statement: "ST Arah Empat Syarikat Pengimport Musnah Kelengkapan Elektrik Yang Tidak Selamat" | 02/04/2018 |

| 170 | Media Statement: "Pelantikan Pengerusi Suruhanjaya Tenaga (ST) Baharu" | 02/04/2018 |

| 171 | Media Statement: "KeTTHA dan ST Anjur Dialog TN50 dan SDG 2030" | 29/03/2018 |

| 172 | Electrical Equipment Recall Notice | 06/03/2018 |

| 173 | “Rampasan Terbesar ST Dalam Tempoh 5 Tahun” | 01/03/2018 |

| 174 | RM850 Million Saved with the Implementation of MEPS | 01/03/2018 |

| 175 | Energy Efficiency Challenge 2018 | 01/03/2018 |

| 176 | TNB to bear RM929.37m in electricity rebates for first six months of 2018 | 01/03/2018 |

| 177 | "Pelarasan Tarif Elektrik di Kulim Hi-Tech Park, Kedah bagi Tempoh 1 Januari 2018 hingga 30 Jun 2018 bagi Pengguna Kategori Industri dan Komersil" | 01/03/2018 |

| 178 | Notice on Product Recall for Unlabelled Electrical Equipment As a Requirement for Reapplication of New CoA | 01/03/2018 |

| 179 | Electricity Tariff Review in Peninsular, Sabah and Federal Territory of Labuan Effective on 1 January 2018 | 27/12/2017 |

| 180 | Electrical Equipment Recall Notice | 26/12/2017 |

| 181 | "Kerosakan Perkakasan Pembekalan 33 KV Menyebabkan Insiden Gangguan Bekalan Elektrik di Perling, Johor" | 20/12/2017 |

| 182 | "ST Arah Pengimport Lupus Kelengkapan Elektrik yang Tidak Selamat" | 08/12/2017 |

| 183 | Announcement of Shortlisted Bidders for the Development of Large Scale Solar Photovoltaic (LSSPV) Plants for Commercial Operation in Peninsular Malaysia, Sabah and Federal Territory of Labuan, 2019 – 2020 | 06/12/2017 |

| 184 | Notification on Chargeman Competency Examination (Theory) for Session 1/2018 | 04/12/2017 |

| 185 | "Kenyataan Suruhanjaya Tenaga Mengenai Semakan Harga Gas Asli bagi Sektor Bukan Elektrik di Semenanjung Malaysia bagi Tempoh Januari 2018 hingga Jun 2018" | 28/11/2017 |

| 186 | Blackout? Know Your Rights | 27/11/2017 |

| 187 | Launch of Malaysia Energy Statistics Mobile Application | 22/11/2017 |

| 188 | Speech by the Energy Commission’s Chairman, Dato' Abdul Razak Abdul Majid, at the launch of Malaysia Energy Statistics Mobile Application during the Regional Workshop on Energy Statistics for ASEAN Countries held on 21-23 November 2017 | 22/11/2017 |

| 189 | "Kaedah-Kaedah Keselamatan Semasa dan Selepas Banjir" | 16/11/2017 |

| 190 | "Teks Ucapan Pengerusi Suruhanjaya Tenaga Sempena Majlis Penyampaian Hadiah Energy Efficiency Challenge 2017" | 14/11/2017 |

| 191 | "Penjimatan Elektrik Bernilai Hampir RM160,000 Melalui EE Challenge 2017" | 14/11/2017 |

| 192 | "Suruhanjaya Tenaga Bantu Tambah Baik Sistem Pendawaian Sekolah Tahfiz" | 06/11/2017 |

| 193 | “Suruhanjaya Tenaga Berjaya dalam Kes Pendakwaan Kesalahan Mencuri Elektrik” | 25/10/2017 |

| 194 | "ST Arah Pelupusan Kelengkapan Elektrik yang Tidak Selamat" | 24/10/2017 |

| 195 | “Suruhanjaya Tenaga Siasat Letupan Pemanas Air Hotel di Port Dickson” | 16/10/2017 |

| 196 | Launching of Single Buyer and Grid System Operator Websites | 13/10/2017 |

| 197 | "Notis Pemakluman Pembatalan Perakuan Pendaftaran (Certificate of Registration) Syarikat yang Gagal Mengambil Tindakan Melupus/Menghantar Balik Kelengkapan Elektrik yang Gagal Ujian Konsainmen" | 02/10/2017 |

| 198 | "Polisi Larangan Penerimaan dan Pemberian Hadiah (No Gift Policy)" | 19/09/2017 |

| 199 | Launch and Seminar of Energy Commission's Code and Guideline | 24/08/2017 |

| 200 | Guidelines for Implementation of Gas Framework Agreement (GFA) in the Power Sector (Amendment 1/2017) | 12/08/2017 |

| 201 | Notification on Chargeman Competency Examination (Theory) for Session 2/2017 | 11/08/2017 |

| 202 | Large Scale Solar (LSS) Photovoltaic Plants for 2019/2020 – Bid Opening Price | 10/08/2017 |

| 203 | "Pelarasan Rebat Tarif Elektrik" - Interview with Marlinda binti Mohd Rosli, Head of Electricity Price Unit in Selamat Pagi Malaysia, TV1 on Wednesday 19 July 2017 | 20/07/2017 |

| 204 | "Pelarasan Tarif Elektrik di Kulim Hi-Tech Park, Kedah bagi Tempoh 1 Julai 2017 hingga 31 Disember 2017 bagi Pengguna Kategori Industri dan Komersil" | 30/06/2017 |

| 205 | Gas Supply (Amendment) Regulations 2017 | 20/04/2017 |

| 206 | Speech by the Chairman of Energy Commission, Dato' Abdul Razak Abdul Majid, at the Energy Efficiency Run (EE Run) 2017 held on 15 April 2017 | 17/04/2017 |

| 207 | “Mempromosi Kecekapan Tenaga Melalui EE Run 2017” | 17/04/2017 |

| 208 | Notice of Road Closure and EE Run 2017 Route | 12/04/2017 |

| 209 | Energy Efficiency Challenge 2017 | 05/03/2017 |

| 210 | ST Offers Rewards and Electricity Savings Opportunity for Schools | 24/02/2017 |

| 211 | ST Publishes Statistics on Malaysian Energy Industry | 20/02/2017 |

| 212 | Notice for Second Competitive Bidding Program for The Development of Large Scale Solar Photovoltaic Plant (LSS) In Peninsular Malaysia and Sabah/Labuan: Request for Proposal for Selection of Qualified Developers & Sites | 20/02/2017 |

| 213 | Amendment to the Power Quality Standards under the Energy Commission’s Circular No. 1/2017 | 18/01/2017 |

| 214 | Product Recall Notice for IKEA’s GOTHEM Lamp Base | 16/01/2017 |

| 215 | Notification on Chargeman Competency Examination (Theory) for Session 1/2017 | 11/01/2017 |

| 216 | “Electrical Safety during the Flood Season” with Ir. Fairus binti Abdul Manaf, Head of Electrical Equipment Unit, Energy Commission in Selamat Pagi Malaysia, RTM1, 10 January 2017 | 10/01/2017 |

| 217 | Media Release on Safety Measures During and After the Flood | 10/01/2017 |

| 218 | "Kenyataan Suruhanjaya Tenaga Mengenai Semakan Harga Gas Asli Bagi Sektor Bukan Elektrik di Semenanjung Malaysia" | 28/12/2016 |

| 219 | Announcement of Shortlisted Bidders for the Development of Large Scale Solar Photovoltaic (LSSPV) Plants for Commercial Operation in Peninsular Malaysia and Sabah, 2017 – 2018 | 21/12/2016 |

| 220 | Interview with Ir. Azhar bin Omar, Energy Commission's Senior Director of Industry Development and Electricity Market Regulation Department on Electricity Rebate in Selamat Pagi Malaysia, RTM1, 16 December 2016 | 19/12/2016 |

| 221 | Energy Commission's Statement on Electricity Tariff Adjustment at Kulim Hi-Tech Park, Kedah for the Period of 1 January 2017 to 30 June 2017 for Industrial and Commercial Consumer | 16/12/2016 |

| 222 | Speech by the Chairman of Energy Commission, Dato' Abdul Razak Abdul Majid, at the Energy Efficiency Challenge 2016 Prize Presentation Ceremony | 08/11/2016 |

| 223 | "Menyemai Amalan Menjimatkan Tenaga Sebagai Budaya Generasi Muda" | 08/11/2016 |

| 224 | "Mesyuarat Panel Perundingan Tenaga Negeri Sabah (PPTNS) Bil. 1/2016" | 21/10/2016 |

| 225 | Press Release Regarding Workshop on Guidelines and Techniques of Identifying Substandard Cables and Related Products | 11/10/2016 |

| 226 | Guidelines on the Adoption of the Validity Period for Test Reports for New Applications and Renewal of Certificate of Approval (CoA) Based on Risk Category of Electrical Equipment | 10/10/2016 |

| 227 | Public Lecture on "Energy Security in Asia: Growing Uncertainties and Challenges for the Future" by Professor Dr. Ken Koyama, 4 October 2016 | 05/10/2016 |

| 228 | Large Scale Solar Photovoltaic Plant (LSS) For 2017/2018 - Bid Opening Price | 30/09/2016 |

| 229 | Welcome Remark by Dato’ Abdul Razak bin Abdul Majid, Chairman of the Energy Commission at the 7th National Energy Forum, 8 Sept in Kuala Lumpur | 09/09/2016 |

| 230 | Press Release on the 7th National Energy Forum | 09/09/2016 |

| 231 | Energy Efficiency Challenge 2016 Online Survey | 09/08/2016 |

| 232 | Rectification on BERNAMA’s report on Electricity Rebate | 05/08/2016 |

| 233 | Customer Satisfaction Survey on Energy Commission’s Services | 25/07/2016 |

| 234 | "Notis Penutupan Perkhidmatan Server Suruhanjaya Tenaga Bagi Tujuan Kerja-Kerja Penyenggaraan Sistem Elektrik di Bangunan Suruhanjaya Tenaga, Putrajaya" | 14/07/2016 |

| 235 | Notice on PSS Requirement for RFP Submission-Distribution Connected | 28/06/2016 |

| 236 | Notice on PSS Requirement for RFP Submission-Transmission Connected | 28/06/2016 |

| 237 | "Kenyataan Suruhanjaya Tenaga Mengenai Semakan Semula Harga Gas Asli Bagi Sektor Bukan Elektrik Di Semenanjung Malaysia " | 28/06/2016 |

| 238 | Announcement Notice: Chargeman Competency Examination (Theory) – (A4, B0, B0(TNB), B1 and B4) for 2/2016 Session | 06/06/2016 |

| 239 | "Kenyataan Media Suruhanjaya Tenaga Mengenai Bahaya Menggunakan Telefon Bimbit Ketika Sedang Dicas" | 21/04/2016 |

| 240 | Response to queries on RFQ of Large Scale Solar Photovoltaic Plant | 18/04/2016 |

| 241 | Notice for Queries to Pre-Qualification Document of RFQ for the Development of Large Scale Solar Photovoltaic Plant in Peninsular Malaysia and Sabah | 17/03/2016 |

| 242 | "Penafian Terhadap Iklan Kad Penjimatan Tenaga" | 16/03/2016 |

| 243 | "Notis Pemakluman Tempoh Sah Laku Laporan Ujian Kelengkapan Elektrik" | 14/03/2016 |

| 244 | Notice for Extension of the Date for the Sale of the Pre-Qualification Document and Submission of RFQ for the Development of Large Scale Solar Photovoltaic Plant in Peninsular Malaysia and Sabah | 08/03/2016 |

| 245 | Clarification on RFQ Participant Pre-Requisites in the Pre-Qualification Document for the Development of Large Scale Solar Photovoltaic Plant in Peninsular Malaysia and Sabah | 07/03/2016 |

| 246 | Notice for the Pre-Qualification of Prospective Bidders & Sites for the Development of Large Scale Solar Photovoltaic Plant in Peninsular Malaysia and Sabah | 29/02/2016 |

| 247 | Electricity Supply (Amendment) Act 2015 [Act A1501]: Appointment of Date of Coming Into Operation: P.U.(B)501 | 19/01/2016 |

| 248 | Announcement Notice: Chargeman Competency Examination (Theory) – (A4, B0, B0(TNB), B1 and B4) for 2016 Session | 08/01/2016 |

| 249 | "Kenyataan Media Kementerian Tenaga, Teknologi Hijau Dan Air (Semakan Traif Elektrik Di Semenanjung, Sabah dan Wilayah Persekutuan Labuan bagi Tempoh 1 Januari hingga 30 Jun 2016)" | 09/12/2015 |

| 250 | "Permohonan secara atas talian di sistem ECOS Online" | 12/11/2015 |

| 251 | "Teks Ucapan Y.B. Menteri Tenaga, Teknologi Hijau dan Air sempena Mesyuarat Pertama Panel Perunding Tenaga Negeri Sabah di Kota Kinabalu Sabah pada 29 Oktober 2015" | 29/10/2015 |

| 252 | "Teks Ucapan YBhg. Dato’ Pengerusi ST sempena Mesyuarat Pertama Panel Perunding Tenaga Negeri Sabah di Kota Kinabalu Sabah pada 29 Oktober 2015" | 29/10/2015 |

| 253 | "Persefahaman Suruhanjaya Tenaga Dengan Bahagian Bekalan Elektrik, Kementerian Kemudahan Awam Sarawak Mengenai Label Keselamatan Kelengkapan Elektrik" | 29/10/2015 |

| 254 | ASEAN Energy Awards 2016 | 15/10/2015 |

| 255 | ST Introduces NEDA to ensure cost effective power generation | 02/10/2015 |

| 256 | The New Enhanced Dispatch Arrangement Rules (NEDA Rules) and Single Buyer Rules | 01/10/2015 |

| 257 | "Pendaftaran pengilang dan pengimport di Sistem e-Dik" | 28/09/2015 |

| 258 | Enforcement of Malaysian Standard (MS) to comply with the Minimum Energy Performance Standards (MEPS) requirements for five electrical equipments (refrigerator, air conditioner, television, domestic fan and lamp) | 14/09/2015 |

| 259 | Acceptance of new IEC Standards for double capped LED lamp and audio video for the application of Certificate Of Approval (COA) | 14/09/2015 |

| 260 | New fee under Gas Supply Regulations (Amendment) 2014 | 20/08/2015 |

| 261 | "Jadilah Bijak Tenaga" | 13/08/2015 |

| 262 | Be Energy Smart | 13/07/2015 |

| 263 | Be Energy Smart | 30/06/2015 |

| 264 | "Kenyataan Suruhanjaya Tenaga Mengenai Semakan Semula Harga Gas Asli Bagi Sektor Bukan Elektrik Di Semenanjung Malaysia" | 09/06/2015 |

| 265 | Application Procedure for Certificate of Approval (COA) | 09/06/2015 |

| 266 | The 6th National Energy Forum to Further Address Malaysia's Quest for Sustainable Energy | 11/03/2015 |

| 267 | Guideline for Obtaining the Certificate of Approval (COA) for LED Lamps under Minimum Energy Performance Standards (MEPS) | 08/03/2015 |

| 268 | Press statement on fuel costs and other generation price review (Imbalance cost pass through - ICPT) and its impact on electricity prices in Peninsular Malaysia, Sabah and the Federal Territory of Labuan, 11 February 2015 | 12/02/2015 |

| 269 | Approval to Install (ATI) and Approval to Operate (ATO) application form updates for natural gas pipeline & additional piping installations | 26/01/2015 |

| 270 | "Kaedah-Kaedah Keselamatan Menghadapi Banjir" | 08/01/2015 |

| 271 | Chargeman Competency Examination (Theory) for 2015 Session | 23/12/2014 |

| 272 | Keynote Speech by Datuk Ir. Ahmad Fauzi Hasan, CEO of Energy Commission at the IEM Symposium on Protection Against Lightning, 27 November 2014 | 21/11/2014 |

| 273 | Press Statement by Ministry of Energy, Green Technology and Water on the Imbalance Cost Pass-Through (ICPT) for Electricity Tariff Review in Peninsular Malaysia, 5 November 2014 | 06/11/2014 |

| 274 | Presentation Slides: Seminar to enhance energy efficiency initiative in Malaysia through legislation and policy | 05/11/2014 |

| 275 | Statement on reviewing of natural gas prices for the non-electricity sector in Peninsular Malaysia | 29/10/2014 |

| 276 | Presentation Slides: The Malaysian Distribution Code Awareness Programme | 29/09/2014 |

| 277 | Presentation Slides: "Seminar Ke Arah Budaya Bijak Tenaga" | 21/08/2014 |

| 278 | Advertorial: Tips on using electricity and gas wisely | 24/07/2014 |

| 279 | Announcement Notice: Gas Contractors and Gas Competent Person are required to use JG8-1 Form for Additional Piped Gas Installations | 18/07/2014 |

| 280 | Press Release: YTL Power International Berhad Withdraws from Participating in the New Combined Cycle Power Plant in Pasir Gudang, Johor | 19/06/2014 |

| 281 | Circular on Examination and Issuance of Certificate of Competency for Chargeman (Restricted) to meet current Industry needs | 10/06/2014 |

| 282 | Press Release: Energy Commission Seizes 2,000 Units of Electrical Goods for Non-compliance | 09/06/2014 |

| 283 | Press Release: The Energy Commission Recognised as Outstanding Government Procurer at PFI Asia Best Practice 2014 | 06/06/2014 |

| 284 | Press Release: Suruhanjaya Tenaga Offers Conditional Award to Consortium to Develop a New 1,000MW – 1,400MW Combined Cycle Power Plant in Johor | 02/06/2014 |

| 285 | Circular on Upgrading of Certificate for Chargeman Categories A4-2, A4-1 to A4 or BO-2, BO-1 to BO and Termination of Examination and Issuing of Certificate for Chargeman Categories A4-2, A4-1, BO-2 and BO-1 | 09/05/2014 |

| 286 | Customer Satisfaction Survey on Services Provided by Energy Commission | 25/04/2014 |

| 287 | Statement on reviewing of natural gas prices for the non-electricity sector in Peninsular Malaysia | 11/04/2014 |

| 288 | Press Release: Announcement of New Chairman of Energy Commission | 07/04/2014 |

| 289 | Announcement Notice: Electricity (Amendment) Regulations 2014 P.U.(A) 73 | 21/03/2014 |

| 290 | Customer Satisfaction Survey on Services Provided by Electric Utility Companies 2014 | 21/03/2014 |

| 291 | Electricity (Amendment) Regulations 2014 P.U.(A) 73: Gazetted on 14 March 2014 | 20/03/2014 |

| 292 | Press Release: Clarifications on the announcement of the result of competitive bidding exercise for project 3B which involves the construction of a new 2x1000 MW coal-fired power plant for commercial operation in 2018/2019 | 10/03/2014 |

| 293 | Press Release: Result of Competitive Bidding Exercise for new capacity 2x1000 MW coal-fired power plants for commercial operation in 2018/2019 | 28/02/2014 |

| 294 | Press Release: Two companies found guilty of electricity theft under Electricity Supply Act 1990 | 24/02/2014 |

| 295 | The Edge interview with the Energy Commission Chairman on improvements in the Power Purchase Agreements (PPA) | 23/01/2014 |

| 296 | Presentation Slide: Strategies for Successful Energy Management Program | 09/01/2014 |

| 297 | Advertorial: Safe and Efficient Usage of Electricity, New Straits Times Monday, 23 December 2013 | 23/12/2013 |

| 298 | Briefing Session on Electricity Tariff Setting in Peninsular Malaysia, 19 December 2013 | 23/12/2013 |

| 299 | Announcement Notice: Chargeman Examination (Theory) for 2014 Session | 13/12/2013 |

| 300 | Announcement by Minister of Energy, Green Technology and Water on the Electricity Tariff Review in Peninsular Malaysia, Sabah and WP Labuan | 03/12/2013 |

| 301 | Implications of Tariff Review to Electricity Consumers in Peninsular Malaysia | 03/12/2013 |

| 302 | Feature Article: International Business Review Cover Page: Custodians of Power - Suruhanjaya Tenaga Malavsia and Energy Security | 14/11/2013 |

| 303 | Presentation Slides: Final Report of Study on Effectiveness of Commercial and Residential Natural Gas Odorisation System in Peninsular Malaysia | 06/11/2013 |

| 304 | Announcement: Determination of one (1) Certificate of Approval (COA) for one (1) model of electrical equipment | 16/10/2013 |

| 305 | Announcement: Registration as a Manufacturer or Importer with The Energy Commission | 11/10/2013 |

| 306 | Media Coverage: The Star, 04 October 2013: Meter accuracy matters - Energy Commission tests 170 digital meters in Klang Valley | 04/10/2013 |

| 307 | Media Statement: Malaysia Tackles Future of Sustainable Energy Heads-On (5th National Energy Forum) | 05/09/2013 |

| 308 | Media Statement: Two companies found guilty under Electricity Supply Act 1990 | 15/08/2013 |

| 309 | Open Tender for 2000 MW Coal-fired Power Plant Project 3B – RFQ participants responding to the pre-qualification process | 14/05/2013 |

| 310 | 2000MW Coal-fired Power Plant Open Tender – Shortlisted bidders pursuant to Project 3B pre-qualification process | 14/05/2013 |

| 311 | Presentation Slides: The Malaysian Grid Code Awareness Programme | 14/05/2013 |

| 312 | Energy Commission Headquarters Building Putrajaya | 05/05/2013 |

| 313 | Public Notice | 05/05/2013 |

| 314 | Gearing Towards Energising Initiatives | 05/05/2013 |

| 315 | Appointment of members of the Energy Commission | 05/05/2013 |

| 316 | Power Quality Baseline Study for Peninsular Malaysia | 05/05/2013 |

| 317 | Media Statement: The Launching of Malaysian Grid Code and Distribution Code Malaysia 2010 | 05/05/2013 |

| 318 | MEDIA STATEMENT: Public Awarenes Conference on Electromagnetic Field (EMF) | 05/05/2013 |

| 319 | Speakers' Presentation Slides: Public Awarenes Conference on Electromagnetic Field (EMF) | 05/05/2013 |

| 320 | Presentation Slides during Workshop on Regulatory Implementation Guidelines (Draft for Discussion) on 8th February 2011 | 05/05/2013 |

| 321 | Energy Efficiency Conserves the Use of Conventional Energy and Promote the Greater Use of Renewable Energy | 21/04/2013 |

| 322 | Advertorial for Electricity Consumers | 21/04/2013 |

| 323 | MEDIA STATEMENT: Company Found Guilty of Electricity Theft | 21/04/2013 |

| 324 | Energy Efficiency Criteria for Material and Electrical Equipment to Qualify for Energy Efficiency Incentives: Insulation Material | 21/04/2013 |

| 325 | MEDIA STATEMENT: Diamond Building Officiating Ceremony and Energy Commission 10th Year Anniversary Celebration | 21/04/2013 |

| 326 | Electricity Tariff Schedule | 21/04/2013 |

| 327 | Notice of Suspension of SREP Programme Application | 21/04/2013 |

| 328 | New Electricity Tariff Structure & Rates for Sabah & Federal Territory of Labuan | 21/04/2013 |

| 329 | Presentation Slides: National Conference on Electrical Safety, 21-22 July 2011 at Kuala Lumpur Convention Centre (KLCC) | 21/04/2013 |

| 330 | Press Release: Circular On Buildings' Lightning Protection System | 21/04/2013 |

| 331 | Participation of Energy Commission Chairman, Y. Bhg Tan Sri Dr Ahmad Tajuddin Ali at The 8th Science and Technology in Society (STS) forum Kyoto, Japan | 21/04/2013 |

| 332 | Presentation Slides: International Regulatory Forum, 11 October 2011 at JW Marriot Hotel, Kuala Lumpur | 21/04/2013 |

| 333 | Press Statement : 1,000 MW Coal-Fired Power Plant Project At Tanjung Bin Power Station, Johor | 20/04/2013 |

| 334 | Presentation Slides: Power Quality Stakeholder Workshop 1, 19 November 2011 at PWTC | 20/04/2013 |

| 335 | TV Commercial: Energy Conservation and Energy Efficiency | 20/04/2013 |

| 336 | News Highlight: Sinar Harian, one of the leading malay newspaper in the country has featured the Energy Run event (Larian Tenaga) organized by the Commission recently | 20/04/2013 |

| 337 | Advertorial: Energy Saving Device DOES NOT save electricity as claimed | 20/04/2013 |

| 338 | Presentation Slides: Workshop on Energy Statistics and Energy Balance: An Introduction to Data Providers | 20/04/2013 |

| 339 | News Coverage: Berita Harian published an article on ST entitled "Orang ramai diminta guna kontraktor elektrik berdaftar", 15 December 2011, Thursday | 20/04/2013 |

| 340 | News Coverage: Berita Harian (Northern Edition), 21 December 2011 has featured a news on "Kilang disyaki curi elektrik diserbu - Pemeriksaan kesan wayar asing pada pendawaian di antara suis gear dan meter" | 20/04/2013 |

| 341 | Announcement Notice: Low Voltage Chargeman (A0 and A1) and Wireman Competency Examination 2012 | 20/04/2013 |

| 342 | The Competitive Bidding Exercise for the New Combined-Cycle Power Plants | 20/04/2013 |

| 343 | Issuance of RFQ Document for Pre-qualification of Bidders | 20/04/2013 |

| 344 | News Coverage: The Edge has featured the recent interview with Tan Sri Datuk Dr Ahmad Tajuddin Ali, Chairman of the Energy Commission about EC's future plans for the power sector | 20/04/2013 |

| 345 | News Coverage: "ST dan SESB serbu premis sambung elektrik haram" in Utusan Borneo Sabah, 9 February 2012 | 20/04/2013 |

| 346 | International Competitive Bidding - List of participants who submitted their pre-qualification statements for the Prai CCGT power project | 18/04/2013 |

| 347 | Presentation Slides: National Energy Security Conference, 28 February 2012 at Sime Darby Convention Centre, Kuala Lumpur | 18/04/2013 |

| 348 | Media Coverage in The Star newspaper: National Energy Security Conference, 28 February 2012 at Sime Darby Convention Centre, Kuala Lumpur | 18/04/2013 |

| 349 | International Competitive Bidding: Shortlisted bidders for the Prai CCGT power project pursuant to the pre-qualification process. | 18/04/2013 |

| 350 | International Competitive Bidding: Request For Proposal for the Prai CCGT power project | 18/04/2013 |

| 351 | Request For Proposal for the renewal of operating licence of power plants under the first generation PPAs to extend the period for 5 or 10 years under a Revised PPA post-2016 | 18/04/2013 |

| 352 | Presentation Slides: Executive talk on risk management in the power sector | 18/04/2013 |

| 353 | Suruhanjaya Tenaga collaborates with CEC, USA in enhancing energy regulation | 17/04/2013 |

| 354 | Media Statement: Suruhanjaya Tenaga is investigating the electrocution case in Melaka | 17/04/2013 |

| 355 | Survey on customer satisfaction: Performance level assessment on the services of the national electricity company | 17/04/2013 |

| 356 | Announcement Notice: Additional categories of electrical equipment that requires Certificate of Approval (COA) | 17/04/2013 |

| 357 | Speech Text: Opening Address by YB Dato’ Sri Peter Chin Fah Kui, Minister of Energy, Green Technology and Water Malaysia (KeTTHA) at the “Fourth National Energy Forum 2012”, 27 September 2012 | 17/04/2013 |

| 358 | Speech Text: Welcoming Remarks by Datuk Abdul Rahim Haji Hashim, President, Malaysian Gas Association (MGA) at the “Fourth National Energy Forum 2012”, 27 September 2012 | 17/04/2013 |

| 359 | Presentation Slides: Fourth National Energy Forum 2012, 27 September 2012 at Sheraton Hotel, Kuala Lumpur | 17/04/2013 |

| 360 | Media Statement: Results of International Competitive Bidding for New Capacity in Prai and Restricted Tender for Renewal of Operating Licenses of First Generation IPP and TNB Plants | 17/04/2013 |

| 361 | The Edge Daily, 15 October 2012: Looking at the Future of Power (by Nadia S Hassan) | 17/04/2013 |

| 362 | TNB signs agreements worth RM2.47 billion for Seberang Prai combined cycle gas turbine power plant | 13/04/2013 |

| 363 | Coal fired power plant open bidding: Pre-qualification results for 1000MW Project 3A | 13/04/2013 |

| 364 | 1000MW and 2000MW coal-fired power plant projects | 21/01/2013 |

| 365 | Announcement: Coal fired power plant open bidding | 20/01/2013 |

| 366 | Announcement: Closing Date for Manufacturers to Apply for Tax Incentives of Locally Manufactured Energy Efficient Products | 11/12/2012 |

Energy Commission,

Energy Commission,No. 12, Jalan Tun Hussein, Precinct 2, 62100 Putrajaya, Malaysia.

Toll Free: 1-800-2222-78 Tel: (603) 8870 8500 Fax: (603) 8888 8637

2025 © Energy Commission. All Rights Reserved.

Best viewed in 1366 x 768 using Google Chrome or Mozilla Firefox. This website is mobile responsive.

.png)

.png)

.jpg?1582594931096)

%20Plants%20for%20Commercial%20Operation%20in%20Peninsular%20Malaysia%2C%202021.jpg?1577096570980)

.jpg?1575629879773)

%20Photovoltaic%20Plant%20in%20Peninsular%20Malaysia.jpg?1550136004929)

Click

Click

Click

Click

Click

Click

Click

Click

Click

Click  Click

Click  Click

Click